Moreover, predatory lending practices exist, wherein unscrupulous lenders take advantage of these in vulnerable financial situations.

Moreover, predatory lending practices exist, wherein unscrupulous lenders take advantage of these in vulnerable financial situations. Borrowers should remain vigilant, studying the nice print and ensuring they absolutely perceive any loan agreement before committing to

It can be sensible to speak with the lender if financial difficulties arise. Many lenders are prepared to work with borrowers facing temporary hardships, doubtlessly offering adjusted cost plans or deferment options. Open communication can often lead to more manageable compensation te

Another crucial side to assume about is the total mortgage amount. Lenders often set limits based mostly on income ranges, creditworthiness, and the meant purpose of the mortgage. Borrowers should be positive that the amount they are requesting aligns with their capacity to repay, taking into account their general financial health and different obligati

Credit-deficient loans represent a significant problem in the financial world. These kinds of loans are sometimes sought by individuals who struggle with low credit score scores however need access to funds for varied functions. Understanding the intricacies of credit-deficient loans can empower borrowers to make informed selections. In this text, we'll delve into the details of credit-deficient loans, their implications, and how 이지론 they are often navigated successfully. Additionally, we are going to introduce BePick, a comprehensive platform dedicated to providing crucial insights and critiques on credit-deficient lo

Secondly, understand the terms of the mortgage, including rates of interest and fees. Pawnshop loans usually come with higher rates of interest, reflecting their unsecured nature and quick processing time. Ensure that you could meet the reimbursement schedule to avoid losing your collate

Moreover, the competition amongst cellular lenders can result in better offers for consumers. Many firms offer promotional rates of interest and versatile reimbursement choices, prompting borrowers to buy around and discover probably the most advantageous phrases suited to their scena

Benefits of Monthly Loans One of the first benefits of month-to-month loans is their structured reimbursement plan. Borrowers favor the mounted payment schedule, which presents readability and assurance throughout the loan time period. Always understanding the quantity due each month helps handle monetary expectations and reduces the likelihood of missed payme

They are also helpful for people who need to consolidate debt or cowl short-term monetary gaps. By opting for a cell mortgage, debtors may discover it easier to handle monthly funds with out the danger of accumulating

Additional Loan debt through credit cards or different high-interest financing choi

Yes, negotiating the mortgage amount is commonly attainable at pawnshops. If you believe your item is worth more than what the pawnbroker presents, you can present your case. It’s essential to have supporting evidence, such as receipts or appraisals, to justify your request for a higher loan quant

Whether you are in search of particular loan merchandise or looking for guidance on improving your credit score rating, BePick is a trusted partner in achieving your financial goals. With a dedication to transparency and education, BePick helps demystify the lending process for all us

Mobile loans may be secure if borrowers choose respected lenders and are diligent in studying loan terms. Scams exist within the lending industry, so it’s critical to verify lender credibility, examine choices, and make sure that the lender complies with regulatory standards before continuing with a mortgage util

Educating yourself about loan terms and circumstances is equally essential. Understand the rate of interest, reimbursement schedule, and any potential fees, and do not hesitate to ask questions if the terms are uncl

As the cell loan market continues to expand, it is important to find dependable assets to assist in your decision-making course of. One such useful resource is Bepick, a devoted website that provides complete data and detailed critiques about varied cell

Student Loan companies. Bepick offers sensible insights, comparisons, and resources to empower users to make informed decisions tailor-made to their monetary wa

Mobile loans can be a viable resolution for varied conditions. They are notably

이지론 helpful throughout emergencies, such as unexpected medical bills or urgent house repairs when traditional financing options will not be accessible rapidly suffici

Another danger includes the high-interest rates sometimes associated with these loans. Borrowers should calculate the total compensation amount and guarantee they can meet the phrases throughout the specified timeframe. Failure to take action can result in financial pressure, making it important to strategy pawnshop loans with caut

Unraveling the Enigma of Satta King 786: A Comprehensive Insight into Online Gambling

Unraveling the Enigma of Satta King 786: A Comprehensive Insight into Online Gambling

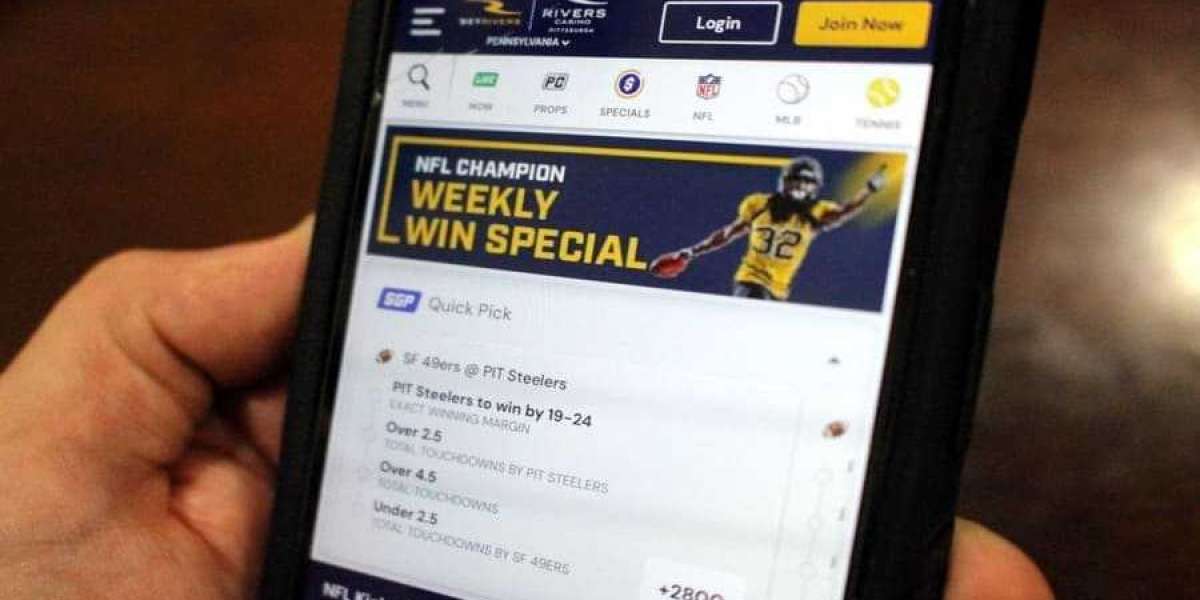

Mostbet official website of the bookmaker

By John Farr’s

Mostbet official website of the bookmaker

By John Farr’s Unveiling the Enigma of Satta King: A Guide to the Fascinating World of Satta Matka

By Redwan Ahmed

Unveiling the Enigma of Satta King: A Guide to the Fascinating World of Satta Matka

By Redwan Ahmed Transform Your Photos with Image to Cartoon AI Free Tools

By Redwan Ahmed

Transform Your Photos with Image to Cartoon AI Free Tools

By Redwan Ahmed Transform Your Pictures with Photo to Cartoon AI Free Tools

By Redwan Ahmed

Transform Your Pictures with Photo to Cartoon AI Free Tools

By Redwan Ahmed